In the realm of personal finance and fiscal management, two essential documents play distinct roles in providing an individual with insights into their financial health and conducting various transactions: the paystub and bank statements. While these documents might seem similar at a glance, they serve distinct purposes and contain unique information critical for different financial activities. This article delves into the disparities between paystubs and bank statements, highlighting their significance in diverse financial contexts.

Introduction to Paystubs

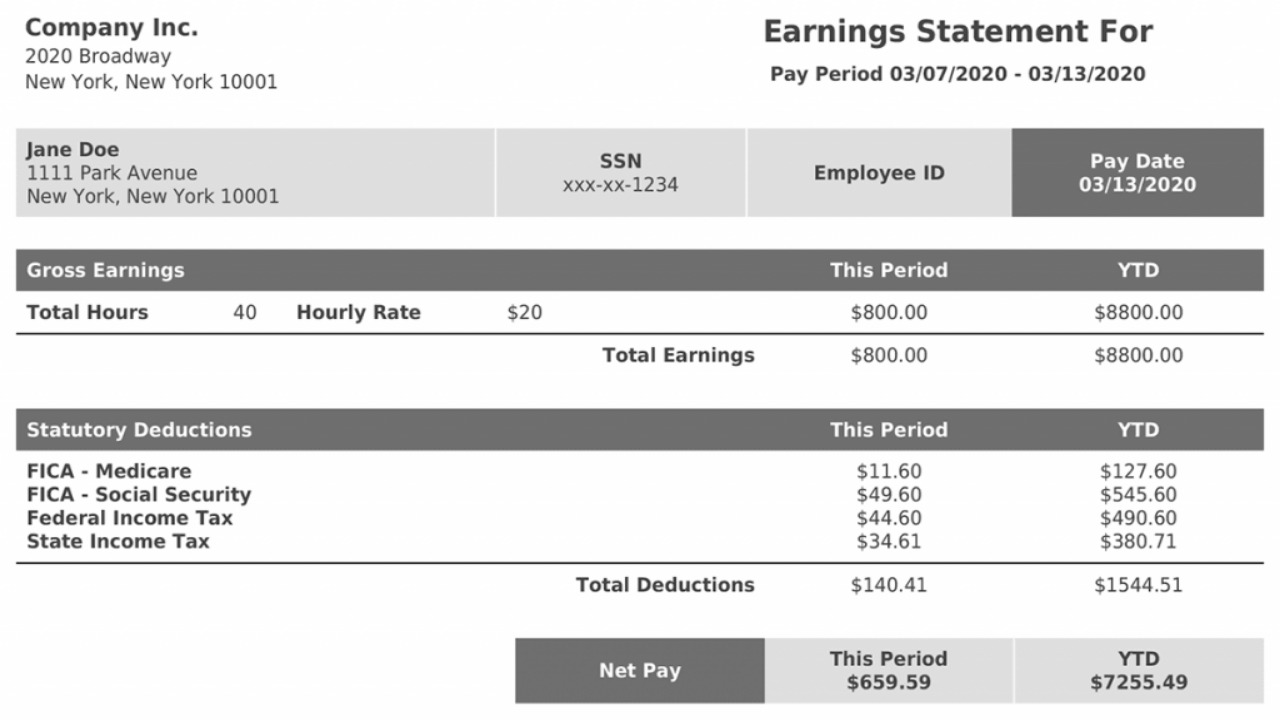

A paystub, alternatively referred to as a paycheck stub or pay advice, is a record furnished by an employer to an employee. This document outlines the remuneration the employee has accrued within a designated pay duration. Paystubs provide a breakdown of an employee’s earnings, deductions, taxes, and net pay, offering transparency into the financial transaction between the employer and employee. They are typically generated by a pay stub generator and are used for both record-keeping and as proof of income.

Components of a Paystub

A paystub contains a range of important information, including gross earnings, which is the total amount an employee earns before deductions. Deductions such as taxes, Social Security contributions, health insurance premiums, and retirement contributions are then subtracted from the gross earnings to calculate the net pay – the amount an employee actually receives in their bank account. Additional components might include overtime pay, bonuses, and reimbursements.

Introduction to Bank Statements

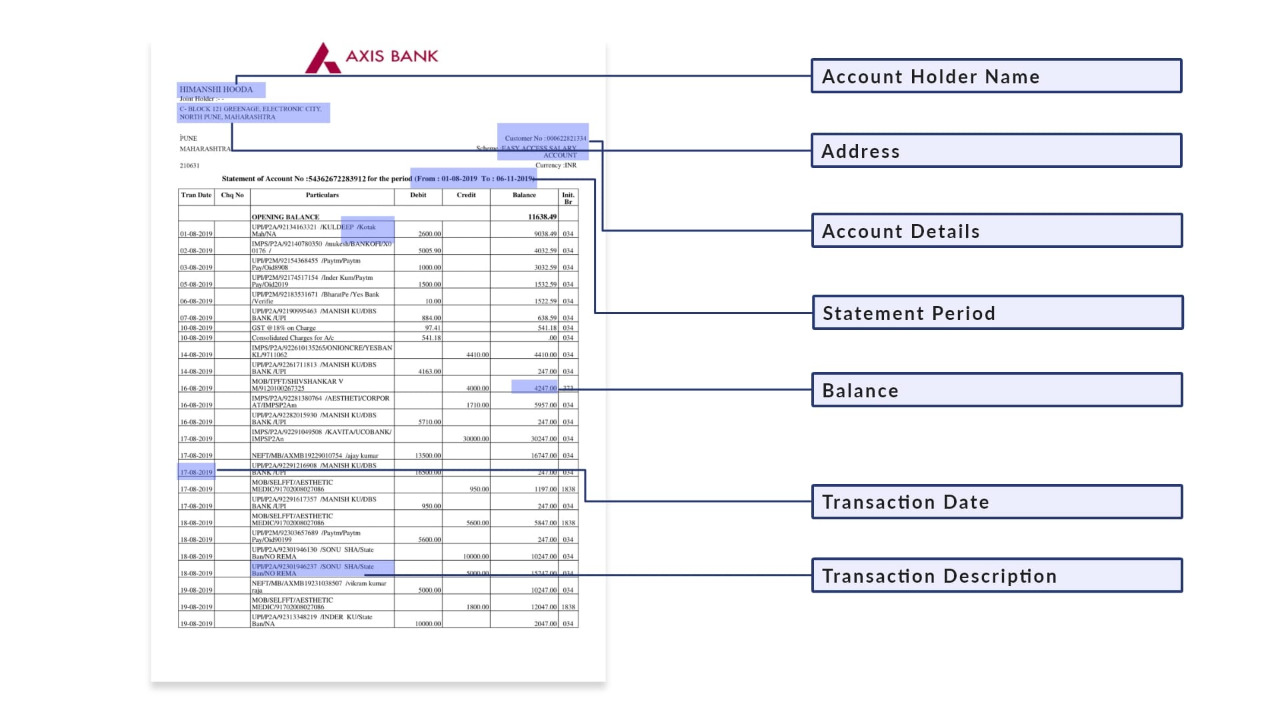

A bank statement is a summary of an individual’s financial transactions conducted through a specific bank account over a defined period, typically a month. It provides a comprehensive overview of deposits, withdrawals, transfers, and any associated fees or charges. Bank statements are issued by financial institutions to their account holders and are invaluable tools for tracking spending, monitoring account balances, and reconciling financial records.

Components of a Bank Statement

Bank statements contain details about each transaction made within the account during the specified period. This includes deposits, such as paychecks, interest earnings, and funds transferred from other accounts, as well as withdrawals for expenses, transfers to other accounts, and payments made using debit cards or checks. The statement also includes information on fees, service charges, and any adjustments made to the account.

Role in Financial Transactions

Both paystubs and bank statements play crucial roles in facilitating different financial transactions. Paystubs are often required when applying for loans, mortgages, or credit cards, as they provide lenders with evidence of a borrower’s income and ability to repay. They also serve as essential documents during tax filing, ensuring accurate reporting of earnings and deductions. On the other hand, bank statements are indispensable for budgeting and assessing spending patterns. They are used when applying for rental agreements, demonstrating financial stability to landlords. Additionally, bank statements aid in identifying unauthorized transactions, resolving disputes, and maintaining a clear financial record.

Verification and Auditing

Paystubs are utilized for verifying an individual’s employment and income, which is essential for background checks during job applications or tenancy agreements. Bank statements, on the other hand, serve as a trail of financial activities. They offer a transparent record of all monetary transactions, helping individuals and businesses track their financial health, detect any discrepancies, and ensure compliance with financial regulations.

Conclusion

In the complex landscape of personal finance, understanding the differences between paystubs and bank statements is essential. These documents, while distinct in purpose and content, provide invaluable information for various financial transactions and activities. While paystubs shed light on an individual’s earnings and deductions, bank statements offer a comprehensive view of their spending and transaction history. Both documents empower individuals to make informed financial decisions, manage their resources efficiently, and navigate the intricacies of modern financial systems.